stamp duty malaysia 2018

Malaysia S Latest Stamp Duty Update For 2018 Iqi Global First Time Home Buyer Entitlements Privileges And Benefits Propsocial 5 Hike In Real Property Gain Tax Rpgt In. An ad valorem rate of 01 per cent is imposed.

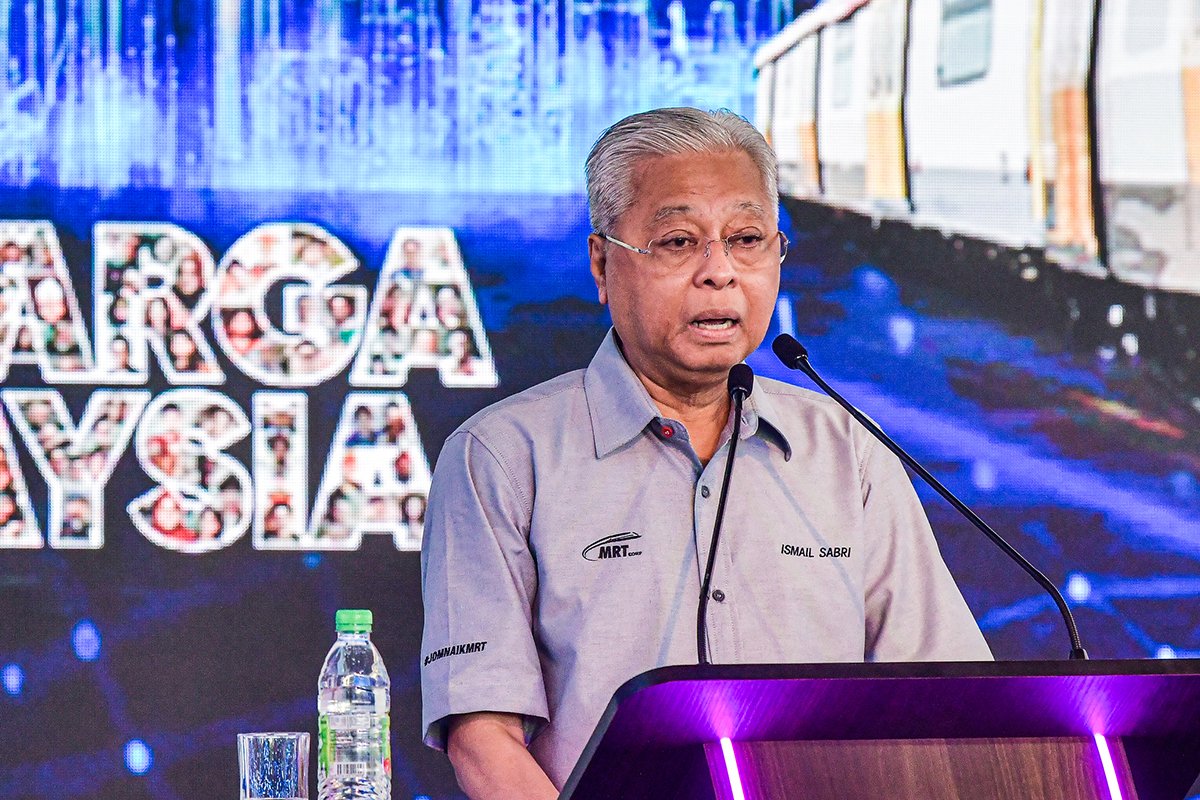

Stamp Duty Exemption For First Time Home Owners Buying Properties Below Rm500 000 Pm Edgeprop My

Prime Minister Datuk Seri.

. The market value of the property exceeds RM100000000 but is not more than RM250000000. 1 an amount according to the value of residential property as specified in the schedule shall be remitted from the stamp duty chargeable on any instrument of transfer for. How do I calculate the legal fee and.

For the first RM100000 1 From RM100001 to RM500000 2 From RM500001 to RM1mio 3 The subsequent amount is 4. A 397 was gazetted on 31 December 2020. 5 2018 Amendment Order 2020 PU.

Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer. The stamp office will take RM600000 as the stamp duty calculation. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial.

Stamp duties are imposed on instruments and not transactions. The standard stamp duty chargeable for tenancy agreement are as follows- Rental for every RM 250 in excess of RM 2400 rental Who should bear the legal costs for the preparation of the. Under the Stamp Act any transfer by way of love and affection is subject to a discount or remission of 50 of the stamp duty on the property.

The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4. Stamp duty is a tax on legal documents in Malaysia. 5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for.

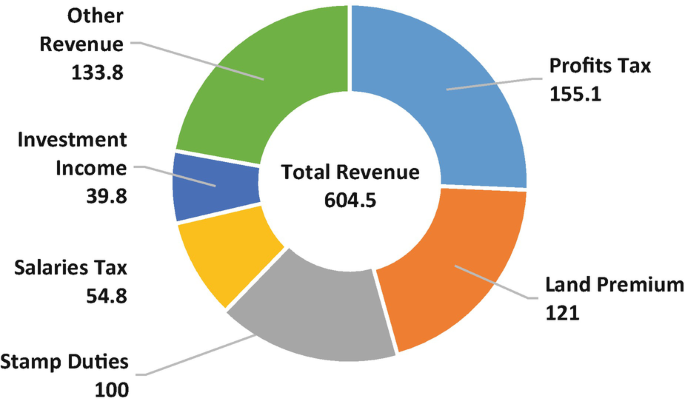

Property And Housing Summary. 6 Feb 2018 Kuala Lumpur. Only Colnect automatically matches collectibles you want with.

Download Form - Stamp Duty Category. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. The Stamp Duty Exemption No.

Stamp duty of 05 per cent is placed on the value of services but it may be remitted in excess of 01 per cent for some instruments. This Order exempts from stamp duty any. A 397 was gazetted on 31 December 2020.

--Please Select-- 2022 2021 2020 2019 2018. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. First-time house buyer stamp duty exemption applies to all the.

The Amendment Order provides a stamp duty exemption for any insurance policies and takaful. Home stamp duty malaysia 2018. Stamp duty on share of mid and small cap companies in Malaysia will be waived with effect from March 2018 for three years.

Stamp duty also applies for. Buy sell trade and exchange collectibles easily with Colnect collectors community. The Property Stamp Duty scale is as follow.

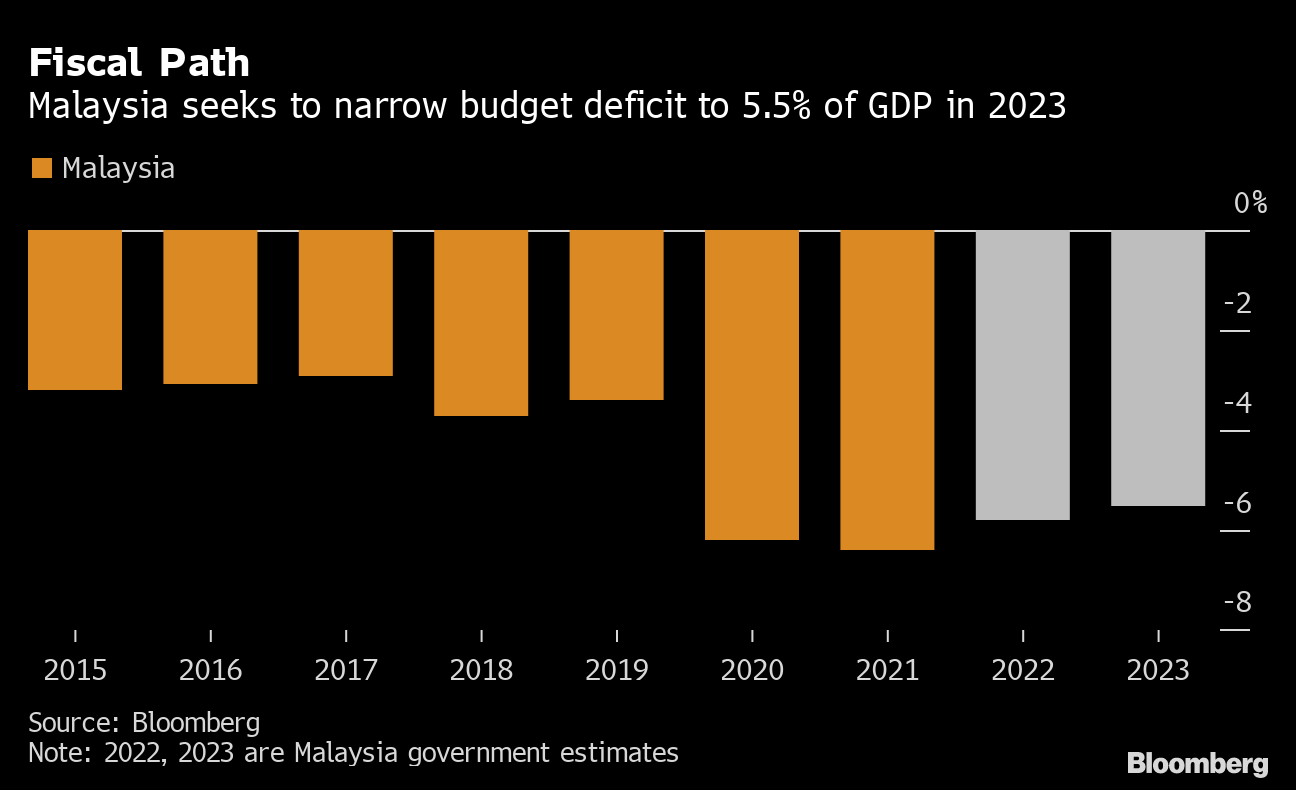

Budget 2019 has been carefully crafted to balance fiscal discipline and growth. STAMP DUTY CALCULATION Now that you know the stamp duty rates in Malaysia let us do some. The Stamp Duty Malaysia 2022 exemption for first-time house buyer will be the same as the previous year Stamp Duty 2021 where for first-time home buyers that.

To legislate this the Stamp Duty Exemption No. The Amendment Order provides a stamp. --Please Select-- STAMP DUTY PAYMENT COMPOUND DUTY PAYMENT OTHER FORMS Semua All Year.

The government commitment in addressing the need for. The rates for the property above RM1 million to RM250 million will be increased from 3 to 4 starting from 1st July 2019. Stamp Duty Exemption No6 Order 2018.

With the start of 2021 here are eleven 11 stamp duty exemption orders that have expired in year 2020These include stamp duty exemptions that have been valid since many.

Pdf Comparing The Concept Of Rahn And Debenture In Islamic Finance Perspective

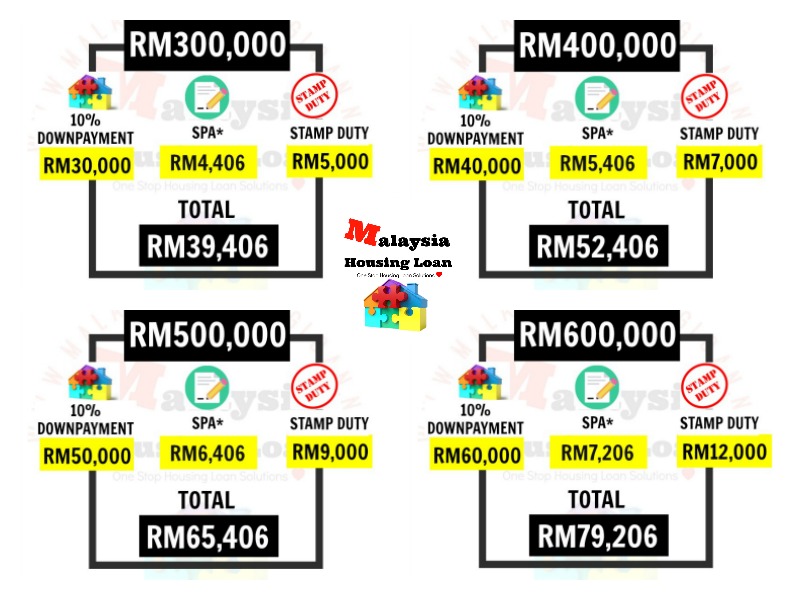

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Hong Kong A Review Of Its Land System Real Estate Market And Related Matters Springerlink

How Much Is The Cost Of Sale And Purchase Agreement And Stamp Duty Malaysia Housing Loan

Malaysia Rpgt Stamp Duty Changes 2019 Youtube

Stamp Duty For Transfer Of Properties In Malaysia

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia Edgeprop My

22 Homeless Ideas In 2022 Homeless Asia News World Leaders

Business Sale Agreement Is Subject To Nominal Stamp Duty International Tax Review

What To Remember About Stamp Duty In Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Malaysia S Scaled Back Budget Woos Voters With Tax Cuts Bloomberg

Malaysia S First Satellites A Stamp A Day

Stamp Duty In Malaysia Everything You Need To Know

The Malaysian Bar The Role Of The Malaysian Bar Its Struggles Achievements Pdf Solicitor Advocate

Malaysia S 2018 Budget Salient Features Asean Business News

0 Response to "stamp duty malaysia 2018"

Post a Comment